Investing in the stock market is just like working-out — everyone knows it’s good for them, yet they still don’t take action. While the stock market might not be able to extend your life, it can certainly improve your financial situation. For example, the 2015 Russell Investments/ASX long-term investing report highlights that the average gross return from Australian shares over last 20 years was 9.5% on a yearly basis.

While there is no infallible way to invest in the stock market, if you follow these three rules to kick-start your portfolio, you’ll certainly be on the right track.

Never buy on tips and rumours

So you heard a ‘hot tip’ at the most recent office party about a great stock, should you go and invest in it? In short, the answer is an explicit no.

A clear-cut rationale behind this thought is that a majority of outspoken analysts and investing gurus underperform compared to broadly selected market indices. Due diligence is a must, otherwise you should not be risking your hard earned capital.

Investing is about developing a sound analytical framework, which boils down to understanding fair value, the past performance, growth potential, financial health and income generated by the asset.

A good way of deciding whether it’s worth investing your time researching the minutiae of a company is by assessing a company’s EPS growth (Earnings Per Share growth) and ROE (Return On Equity).

These two important financial metrics can help to filter out many poor investments.

- EPS growth is calculated on quarterly or year-over-year basis. By taking a look at EPS growth, you can get a handle on whether a company’s profitability is rising or falling.

- ROE is the percentage-return generated by a company with shareholders’ money. If you take a peek at ROEs of different companies in an industry, it becomes clear which of them are generating maximum return for the shareholders.

Understand the risks

Investing in the stock market carries risk. Indeed, all investing does, some lower — such as a term deposits — and some higher — such as foreign exchange trading, usually with corresponding changes in potential returns. The key is to understand the risk and mitigate it. In the case of stock investing, there are two key-risks, systematic risk and unsystematic risk.

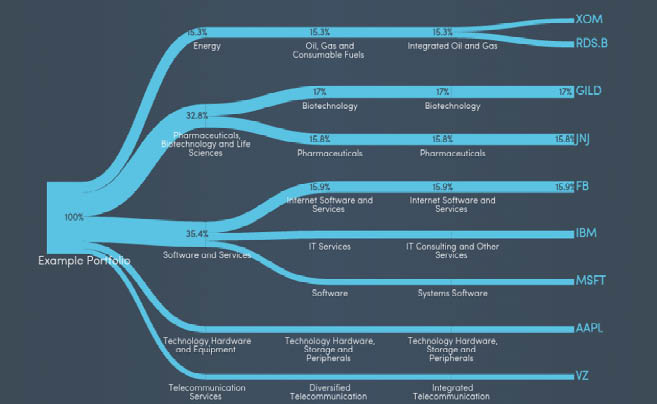

Unsystematic risk, also called business risk, is generally industry specific, as the product or service may become obsolete and be substituted by a better product or service. Business risk also encompasses the probability of a company going bankrupt or being unable to meet its short-term commitments and therefore discontinuing its operations. Business risk can be mitigated through diversification, which can be achieved by investing in industries with minimal correlation. For instance, a well-diversified US-stocks portfolio could look like this:

Systematic risk, also called market risk, is un-diversifiable in nature. It impacts overall market or a significant segment of the market. International trade policies, political regime change, monetary policy and geological events are the primary reasons for market risk. However, if your portfolio is of considerable size, you can use Index-options or Volatility-index options to hedge against overall market volatility.

Avoid behavioural biases

Behavioural biases can be broadly divided into cognitive and emotional biases. Cognitive biases relate to inability to make fact based judgements. An example is Gambler’s Fallacy — no matter how many times you toss a coin, its outcome is random and not related to previous outcomes.

Confirmation bias is another cognitive bias, which results in investors looking for information to confirm their misconception. Cognitive biases can be avoided with sound decision-making process.

Emotional biases are hard to overcome, as they are psychological in nature. These biases often result in short-sighted investing decisions made with the intention to overcome loss or make a quick profit.

Within emotional bias, endowment bias – which causes investors to overvalue their portfolio holdings and retain underperforming assets – is very common among investors.

When it comes to investing, emotions should take a back seat – a good investor is non-emotional and governs on logic.