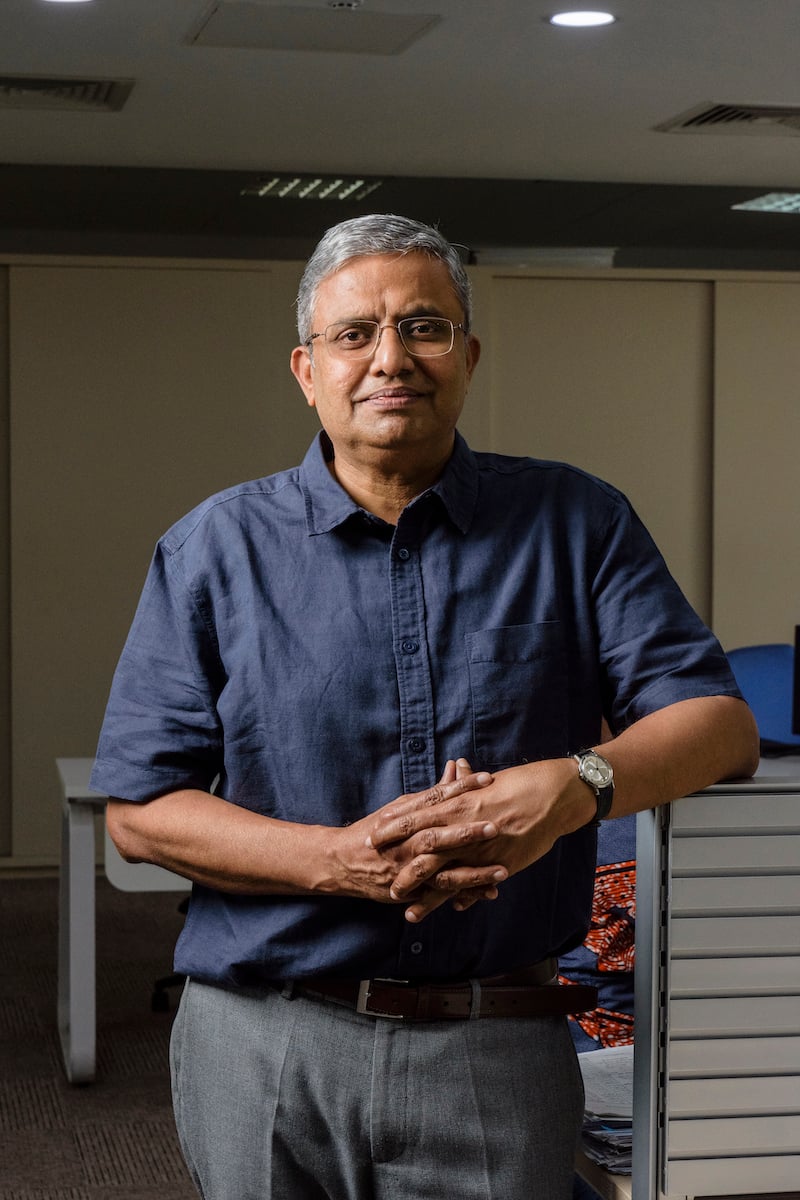

The insurance industry has seen a great deal of disruption and innovation over the past decade, and nobody has been better placed to track these changes than Alliance Insurance Group Managing Director Anantha Krishnan.

Based in the East African insurance market, where the company has offices in Uganda, Tanzania, Comoros and Rwanda, with plans to set up in Kenya, the executive (who prefers to be known as Krishnan) has seen – and taken advantage of – huge shifts in the way people work, do business and protect themselves against potential misfortune.

Insurance is not an industry for the faint of heart, coming as it does with an enormous range of potential issues – not to mention a regulatory overhaul in 2014.

As Krishnan explains, it’s important “to have a real passion for what you do, especially when working in a developing market, where there’s ample opportunity to grow your business, as long as you keep an eye out for those opportunities.

“I enjoy serving people. I enjoy finding solutions to the issues which are before me,” he says. “We have certain values that are core to me personally as well, so work is a pleasure. I have a tendency to make sure that, even if a problem is small, I give it a lot of attention.

“I have a tendency to make sure that even if a problem is small, I give it big attention.”

“Frankly speaking, in our business, you can never say that you’ve learned everything. You need to be a keen learner, and learn every day.”

Learning is rarely a solitary practice, though, and Krishnan is adamant that a strong team leads to strong results.

“If you work on these solutions and, while you’re working, you train people, then you tend to enjoy your work. That’s the only way to work in the insurance industry.”

Perhaps due in part to his decades of experience in business, Krishnan is conscious of how he presents himself, whether he is facing customers or in front of his staff.

Every interaction is an opportunity, not only to help someone solve a problem but also to be a role model for the correct behaviour of his staff.

As you can imagine, he is no fan of hypocrisy in leadership, preferring to rule by example. “You should make sure that what you preach is something you practise yourself. At the end of the day, what is our goal? To be at the top of our business. You need a team behind you,” Krishnan explains.

“We try to develop a culture where our people lend a helping hand to our customers. They hear our customers’ troubles. So, if you ask me what my leadership style is, it is to help my people take care of my customers.

“Basically, if you want to talk, you have to make sure that what you say is matched by your deeds.”

“You have to make sure that what you say is matched by your deeds.”

And, of course, that attitude also extends to business partners. Open and transparent relationships are Krishnan’s watchwords, which makes for extraordinary value on both sides of the bargain.

Where others might put a problem in the too-hard basket, he is willing to put in the work to make things happen. “To give you an example,” Krishnan says, “one of our clients had an interest in Somalia and wanted insurance protection for their project, when that area was considered a war zone. This client approached us after failing to secure support from other insurers.

“As a general rule, the normal response to such requests is no. But we asked who their principal was and what kind of project they were involved in. I realised it was a UN-sponsored project and agreed with our reinsurance partners that projects such as these need to be supported so countries can get back on their feet. It took some time and a lot of effort but ultimately we succeeded. The point is that with positivity and perseverance one can achieve a lot.”

Like any other part of the developing world, Tanzania, and East Africa as a whole, is seeing investment in infrastructure as well as a focus on agriculture, health and education.

“With the aid of technology and by implementing cost-effective strategies that have previously proved successful elsewhere, we are creating significant change in people’s lives,” says Krishnan. “Our aim is to see that we remain a contributor to and beneficiary of this important change.”

A specific example of this that is relevant to Krishnan’s business, is that Tanzania achieved a mobile penetration of 82% in 2015.

As Krishnan says, that’s “a fantastic piece of innovation” that has forced businesses to continually upgrade their services in order to gain, as well as retain, customers.

That’s true on both a micro and macro level. “First of all, in Africa, the penetration of insurance is weak,” Krishnan explains.

“Infrastructure is one of the things taking place that presents an opportunity for us in the way of insurance.”

“So this has provided a great opportunity. Secondly, developments are taking place in Africa where – compared to what we are seeing in fast-developing countries or developed countries – Africa is lagging behind. So we call this the great opportunity for us because Africa is desperately keen to catch up.

“Infrastructure is one of the things taking place that presents an opportunity for us in the way of insurance. Then what else is there? Digitalisation. These days, with technology, you can do things much smarter, more accurately and instantaneously. The benefits you get from using technology outweigh what we have to incur to get on board.”

Proudly supported by: