Deion Campbell started with Trustpower, the original owner of the assets that would become Tilt Renewables, 20 years ago, taking over operational management for the then-largest wind farm in New Zealand. “We took that first foray into wind, and eventually grew it into one of the most respected operator and developer of renewables around,” he recalls.

Today, he’s the CEO of Tilt Renewables, a wind, solar and storage development business that has achieved huge growth, but still remembers its roots as a small part of the Trustpower generation business. At launch in 2016, Tilt Renewables was listed on both the NZX and ASX and operated seven wind farms across Australia and New Zealand, with an installed operating capacity of 582 megawatts, or around 11 per cent of market share in the region. Importantly, the new business also had a big future with a development pipeline of wind and solar options presenting the potential to grow by a further 2,000 megawatts.

According to Deion, the demerger process that created Tilt Renewables was a natural step to secure the opportunities in the local renewables markets. “We had got to the point where some existing shareholders could not fund the growth options and, therefore, we needed to create a new entity, with the ability to attract different shareholders,” he says.

“So, in 2016, we formed Tilt Renewables by demerging the wind assets and pipeline out of Trustpower, essentially one-third of the Trustpower asset base and the associated growth opportunities. Because of my history with developing, building and operating these assets over 15 years with Trustpower, I decided that is where my career should head. At the time, I was General Manager of Generation and Trading and, along with two other Trustpower senior managers, was charged with overseeing the demerger. When the inaugural CEO, who led the establishment of the new company, decided not to carry on, I was offered the role. That was January 2018. The past couple of decades have been a great journey and I think we have created something quite interesting, with an operating model that really suits us.”

The demerger could be compared to a typical company initial public offering, which required new financing, policy development, standalone IT systems, development of a brand, assignment of assets and agreements and even finding an office in a new country. Starting with only three people clearly meant an urgent need to find a team. “We hired around 20 people over a period of six weeks, with most agreeing to join, subject to the demerger actually occurring – such was the interest in what we were creating. We had that startup type of thinking, but with a billion-dollar asset base and serious existing cash flow.”

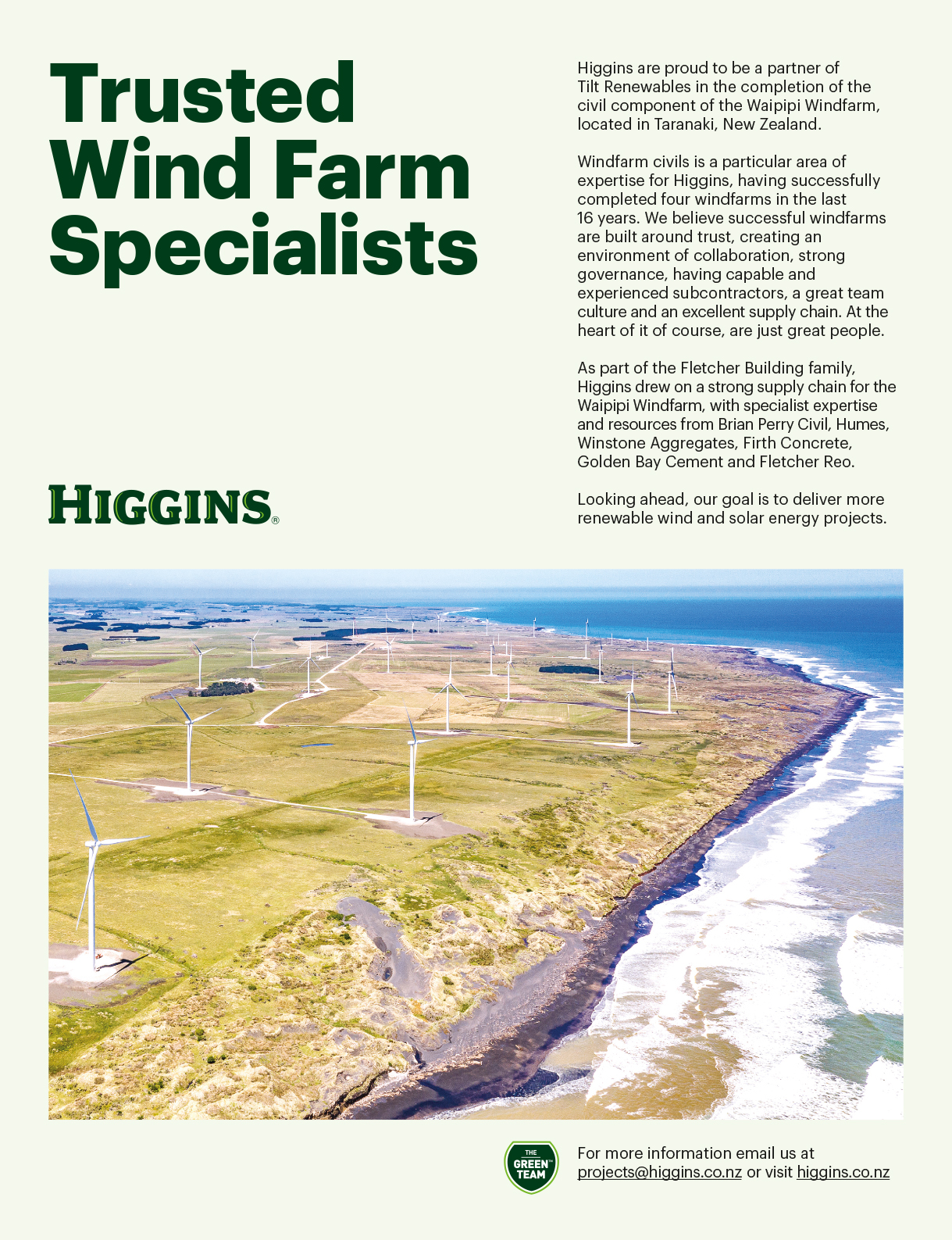

“We also had a great growth pipeline and enough funding to get our first project into construction. The Salt Creek Wind Farm really set us off as we reached financial close without an offtake agreement and went about securing one and then delivered the project very successfully, essentially proving we could do it without the large Trustpower corporate weight behind us. That set us up to push on confidently with our next and largest ever project, the Dundonnell Wind Farm in Victoria and also to surprise the market and kick off the Waipipi Wind Farm in New Zealand, the first large-scale wind farm there for many years. In doing this, we easily delivered on our demerger goal of doubling in our first five years.”

Not content with that, Tilt Renewables then sold its largest operating asset, Snowtown 2 in what was one of the largest transactions in the Australian market and which set Tilt Renewables up with enough funding for known growth options for the next three or four years. “This transaction really put us on the map,” Deion says.

This wasn’t Deion’s first time in the startup environment – among other experiences he served as inaugural Chair of a New Zealand based electric motorcycle startup called UBCO – but the assets and cash flow afforded to Tilt Renewables meant many typical startup challenges did not exist. Having good funding meant the company could take advantage of fully cloud-based IT systems and a “really low corporate overhead” compared to a longer-standing business.

I think we’ve created something quite interesting with a model that suits us.

With a team that remains atypically small for the industry, Tilt Renewables retains some of the strengths of a startup even today. “We’ve still got a bit of a startup feel about us,” Deion says. “We don’t have more people than we need, so if someone shows an interest in something, they are more than likely to be told to go for it. As a result, people with initiative can really broaden their careers and get a more complete understanding of the business. I believe this will result in more rewarding careers and certainly more capable people. It is an outcome that is more difficult in larger organisations. Some of our early team have been poached for very senior roles and I think that is very exciting for me. Some will be the future CEOs of this industry.

We’ve still got a bit of a startup feel about us.

“I believe people at Tilt Renewables get afforded a lot of autonomy and delegated authority. For most people that is very empowering but, for some, those that might be used to a more directive approach, this can be uncomfortable, and those people tend to move on – the startup environment is not for everyone. So we tend to have a team that is pretty much self-directed and empowered to go out and just get it done. That is the entrepreneurial spirit we try to encourage.”

The level of autonomy and empowerment comes with the expectation of high performance and Tilt Renewables gets its pound of flesh. The CEO considers himself to be a fairly demanding leader, although he is careful to avoid interfering unless there is a real need. The flexible, non-hierarchical environment allows a less formal team dynamic and this works in Deion’s favour too.

“If the team were larger, say several hundred people, I just wouldn’t feel the same connection – I like to handwrite Christmas notes to each person for example – that my leadership style depends on. So I think I am in the right scale business for my approach. I guess we will grow beyond that at some point! It is very easy to get sucked in to the idea that if you have a larger team, then you are a more important leader. My focus is on what outcomes the team can deliver for shareholders and other stakeholders and whether we are giving people the opportunities to grow their career. Not just adding people for the sake of it is one of my constant focuses.”

A Wider Scope

As a leader, Deion draws inspiration from the company’s current Chair, Dr Bruce Harker. “He’s quite practical and a deep, deep thinker,” Deion says. “Bruce is very trusting and his approach is to be thinking five steps ahead, especially when things get more complex. I think that is what leadership needs to be – the ability to take care of today but with clear ideas of what is coming and how we need to be ready. Bruce does that really well. He is my inspiration and I enjoy his support.”

Like Bruce, Deion comes from an engineering background, no doubt part of the reason he’s inspired by the Chair. Deion himself has had a career spanning decades in the renewables industry, originally working as a professional engineer in New Zealand’s hydro power stations. Over the course of that career he has had a hand in the delivery of more than A$2.5 billion worth of wind and hydro assets across Australia and New Zealand.

But Tilt Renewables represents his first CEO role, even though he has spent more than a decade in other senior management and executive roles. As CEO, his duties have included large-scale investment decisions, raising equity, returning equity and scrutinising potential acquisition opportunities, along with keeping the company moving forward. For Deion, a change of perspective was required for the transition in 2018 to the CEO role – letting go of his operations focus and taking a broader view of the organisation. “The largest adjustment for me was deliberately trying to avoid the detail associated with the operating assets,” he says. “Letting others take them and run, allowing me to focus on the aspects I was less familiar with, such as corporate finance and investor relations. I found that really interesting and a highlight of the top role.

“One of the things we have maintained since the split from Trustpower, was the belief that subject matter experts in senior roles make for a better business. It means we can have a smaller team, cut to the nub of issues and jump on opportunities very quickly. Our Board completely gets that too. It is the key to getting things right, or at least responding quickly if there is an issue.”

With a team of around 50, Tilt Renewables relies extensively on external suppliers and long-term partnerships. As an example, Siemens Gamesa is the supplier of turbines to the recently completed Waipipi Wind Farm in New Zealand and it has entered into a 30-year agreement with Tilt Renewables to provide operations and maintenance services for that site. It is a model that has been developed over decades, Deion says, with mutual benefits. Siemens Gamesa gets to plan for the site, training staff, stocking spare parts and so on, and Tilt Renewables does not need any its own people to be based at the site. It is a model Tilt Renewables uses at all operating assets.

“Back in the Trustpower days, we were pioneers of that longer-term approach, having the manufacturers look after the assets,” Deion explains. “Our view of the world is that a company like Vestas, which might have 4,000 of that same model machine operating in the world, must have better fleet maintenance data and a better supply chain than we can ever have. Imaging the buying power of Tilt Renewables looking for one gearbox versus Vestas procuring several hundred a year. They know what might go wrong, how to watch for it, plan for it and price it over the long-term.

“So they should always be more efficient at running these machines, which unlike say hydro generators, are not bespoke and several tens of them are installed at a typical wind farm, versus say four or six at a decent size hydro station. It needs a different model.”

Tilt Renewables has continued this approach at its largest ever project, the Dundonnell Wind Farm in Victoria. Tilt Renewables has no-one on site, but its asset experts and project delivery managers do get involved when something important is on or a specific stakeholder requires support.

For example, the landowners and the relationships with them is not left to the turbine suppliers. These relationships along with that of the wider community are crucial Tilt Renewables and the company spends serious effort to get these right.

“In addition, we tend to trust our long-term suppliers and know that we can all focus on the best for project outcome, perhaps using independent engineering experts when a critical item required confirmation, say for the lenders to maintain support, or if a technical issue is beyond the expertise of the in-house team,” Deion says.

“We deliberately set ourselves up knowing we would be reliant on external support, partners of various sorts. I am proud that some of the most capable civil and electrical contracting companies in the market consider Tilt Renewables to be a quality client. This has delivered top class results for us through the time we have been in the industry.

It’s better to have a key selection of external supporters than too many people in our own team.

“We don’t even have an internal legal team to support us at Tilt Renewables. We find the variety of legal work we need is similar to the other technical disciplines – and we don’t need them all the time. It is not possible for one person to be an expert in everything, so it is more efficient to hire the right external expertise at the time you need it. That person should have a broader view of their discipline and when connected directly to the client at Tilt Renewables, will achieve a better outcome, faster.

“I believe it is better to have a key selection of external supporters than to have too many people in our own team. We certainly couldn’t do it that way if we did not have a business model focused on long-term quality relationships and contracting structures. Our business model has been created that way deliberately.”

Across the Tasman

Operating across two national markets, Tilt Renewables has to navigate both, responding to market opportunities with speed and intelligence. “We’ve got an interest in two things,” Deion says. “One is building our next best progressed projects, and we have been clear to the market that for us the next one is in New South Wales followed by one in New Zealand. We’re interested in progressing those to construction over the short-term.

“We’re also interested in making sure our future is secured and that our pipeline is ready to respond to the needs of the market. We’ve got an extensive greenfields development work stream to make sure that our pipeline is appropriately sized and located for the market. What I’d like to see in a couple of years’ time is for us to have delivered another couple of quality wind farms and also to have hands-on experience of what battery storage will bring to the market as that technology matures over the next 5–10 years.”

Our approach has been, for a long time, to work with trusted partners.

As each state in Australia continues to push for decarbonisation, Tilt Renewables is ready to catch the opportunities that arise. “It is a very exciting time to be in control of a market leading asset base and development pipeline,” Deion says.

As far as the choice between solar and wind, Deion thinks the later will prove more in demand, at least until the mix of solar and storage can compete on price. The problem is that solar is all on at the same time and definitely off at the same time. Wind tends to be more variable, including being present at night and, therefore, offers more value to purchasers.

There are of course challenges across both the Australian and New Zealand renewables markets. Deion believes that Australia’s main obstacle is the need to sort out the transmission grid. “The Australian Energy Market Operator, which operates the transmission network, has been asleep as the growth in renewables has occurred and now doesn’t know what to do,” he says. “Last year, that organisation held up the deployment of several hundred megawatts of new renewables in Victoria due to uncertainty in effectively fulfilling the role of market operator. This is a major hurdle for Australia as it transitions to a renewables-based electricity system. A new CEO has been appointed to that entity and the industry is hoping a better leader will help them get ahead of the game.”

New Zealand, meanwhile, has a completely different energy market. Of the electricity produced in New Zealand, around 85 per cent is already renewable so the focus is on the remaining 15 per cent and then increasing the role of electricity in energy consumption overall. Deion believes the key is more diversity in terms of renewable electricity – in particular more wind power in different locations – while determining how New Zealand’s hydro base will be used to support that greater wind penetration.

New Zealand still consumes large amounts of coal and oil, much of it imported. However, Prime Minister Jacinda Ardern, after her election win last October, has committed to getting New Zealand to 100 per cent renewable energy by 2030, eventually joining countries like Iceland and Paraguay. This no doubt opens the door to extensive renewable development and Tilt Renewables is the only credible independent developer with a track record and a pipeline.

In both countries, the government has some role to play in terms of setting targets and providing supporting regulation. However, Deion believes the market is capable and has demonstrated it can solve the renewables revolution on its own, suggesting that governments should have less direct involvement.

Room to Grow

Tilt Renewables was established under the premise that there was substantial growth ahead in the Australian and New Zealand renewables markets, and that Tilt Renewables’ significant pipeline of projects should present shareholders with interesting investment opportunities. Indeed Deion views the company’s pipeline and delivery track record as one of the best available. Tilt Renewables boasts deep industry expertise and experience and has demonstrated it can develop projects that will reach construction, even if that takes many years.

Back in the Trustpower days, we were the pioneers of that longer-term approach, having partners look after these assets.

Deion notes that the business is not currently under pressure to keep delivering new projects, with the existing asset base providing funding to operate as required. This enables Tilt Renewables to move slowly if necessary, to avoid rushing at substandard investments. At the same time, the company has shown it can move fast when an opportunity presents itself.

“Our approach is to be patient, move fast when the market needs us to and to really think about what our customers might be looking for, and make sure we develop it for them,” Deion says. “Then we need to have the right delivery partners ready to move and construct these projects as efficiently as possible to ensure we are supplying competitive electricity. So far we have been successful.”

Tilt Renewables is one of the few developers in the region with proven ability to finance and deliver a renewable project on a ‘multi-contract’ delivery framework. This is important as it allows the company to be more involved with each of the construction disciplines, to take decisions that are best for the entire project and to help when things are getting behind. “We are happy to deliver a project with us being the key contractor and actually get very hands-on even under a more typical engineer, procure, construct model,” Deion says.

“It means we are more aware of risk allocation and can respond to unexpected challenges. COVID-19 is a great example. We were able to go to each contractor at Waipipi and negotiate the best for project approach to the standdown and restart of the site following the enforced shutdown of construction activities. This including finding opportunities to recover lost time. We got really hands-on, focused on the important stuff, including the ongoing safety of everyone on site. Waipipi ended up with the last turbine operating just a few weeks beyond the original schedule, even though we lost effectively six weeks due to COVID-19.”

Across the industry are people and companies that Deion has been working with for decades. The trust built and friendships created means that Tilt Renewables can take a better approach to risk allocation than others. For Deion, the lengthy duration of these business relationships means a longer-term view of what success looks like is maintained when addressing shorter-term challenges. “Our approach has been, for a long time, to work with trusted partners. To focus on outcomes and enjoy our work together. It has been a highlight of my working life.”

Proudly supported by: