From the very inception of fintech WLTH, its Founders, brothers Brodie and Drew Haupt, knew they wanted to build an organization with purpose at its very core. And having grown up steeped in salt spray, it was only natural that the ocean would find its way into the company’s DNA.

“Drew and I grew up surfing, sailing, being at the beach and I suppose early on in life became ocean conservationists without even realizing it,” CEO Brodie Haupt tells The CEO Magazine. “It might seem a little bit odd for a finance or tech company to be involved in dealing with the plastic pollution crisis, but it really speaks to our heart.

“There is a massive issue globally that exists right now and we want to bring awareness to it, but also help by becoming involved in the methodology to create change.”

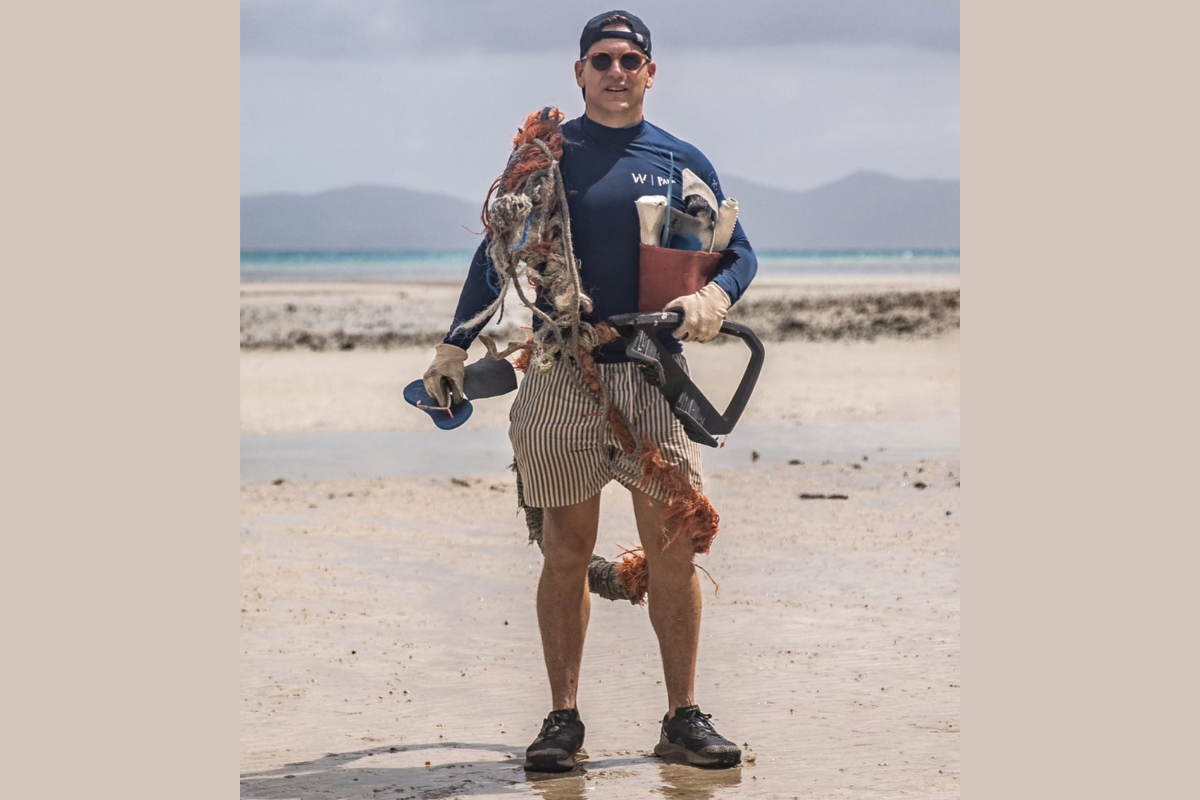

Now, WLTH is working to engage its customer base, the partners it works with and to stir up the rest of the sector into action through its partnership with Parley for the Oceans. “Parley is a global organization that takes action against marine pollution, transforms intercepted marine plastic waste into the materials of tomorrow and supports marine research and material science,” Haupt explains.

“For every loan we settle, we assist and empower Parley to clean up 50 square meters of Australian coastline or beaches. We wanted to bring together an ideology for the business to make sure that purpose is key and at the forefront of everything that we do.”

In November, WLTH also launched a Visa debit card with G+D and Parley made with Parley Ocean Plastic®, a world first, linked to its mortgage offset accounts. “We refer to this as ‘our symbol of change’ in terms of what we’re trying to achieve,” he explains. “Rather than chasing B Corp status or doing a charity partnership, we’re actually involved in it.”

To date, the company has been involved in two “explorations”, traveling up to North Queensland to take part in major cleanup events. It has also signed a multi-year deal with the Australia team in global racing league SailGP.

“We’ve incentivized Team Australia to do impact based on their performance, which is a world-first partnership that we have in place,” he says. “That really gives us the exposure of what we’re trying to develop long-term with WLTH as an organization.”

We wanted to bring together an ideology for the business to make sure that purpose is key and at the forefront of everything that we do.

Full ecosystem approach

While purpose is at the heart of WLTH, it is one part of the company’s “full ecosystem” approach to finance, according to Haupt. “We have one single entry point or one customer portal for all of our customers to come into and see all of our products,” he points out.

Its first product to hit the market was WLTH Lend – a “highly competitive” home loan. Next on the agenda is WLTH Pay, currently in pilot. “That will be a business payments platform utilizing the backend infrastructure tech of our merger partner to enable businesses to pay suppliers, invoices and payroll,” he reveals.

Those that process their payments through the platform can also earn loyalty points through tie-ups with both the Velocity and Qantas Business Rewards schemes. “Later on, we’ll be adding our own payment gateway and our own loyalty points program to round out the full ecosystem-based approach to the organization.”

Haupt is quick to point out that WLTH isn’t a neobank and has no intention of heading in that direction. “We consider that we’ve taken a really prudent approach, which is capital-light and profit-early in the fact that we trade under a credit license, Australian financial services license and we’re registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a domestic remitter,” he says. “What that’s enabled us to do is to get our products into market without the need for really capital-intensive business models.”

Bucking the trend

While other fintechs may have struggled in recent times – with all-digital bank Volt collapsing in July 2022 – WLTH is determined to buck the trend. “Rather than being another statistic, we’re focused on improving the business model, which achieved profitability and the ability for us to get out of cash bank quite quickly for our investors long-term,” he says.

The brothers have a 12-year history of successfully working together on a variety of property and finance companies with their joint experience eventually inspiring their entry into the fintech world. “Through those years we really struggled to find tech solutions or platforms that would support our clients in our business,” Haupt recalls. “We always try to think of the client first – the client experience.”

WLTH is a fully licensed and compliant lending and payments fintech with a core focus on purpose – and that’s part of our DNA.

This led to the launch of procurement and supply management tool Moneymgmt and a proptech tool called Properlytics. So the subsequent launch of WLTH in 2021 was an “organic transition” for the pair with their background in finance and technology.

“We invested into WLTH to get it off the ground and bootstrap it, then ran our own founder-led round to get us to the point where we were post-launch in market, post-revenue, before we went out to market it and try to raise other funds,” he says.

“Now, WLTH is a fully licensed and compliant lending and payments fintech with a core focus on purpose – and that’s part of our DNA.”