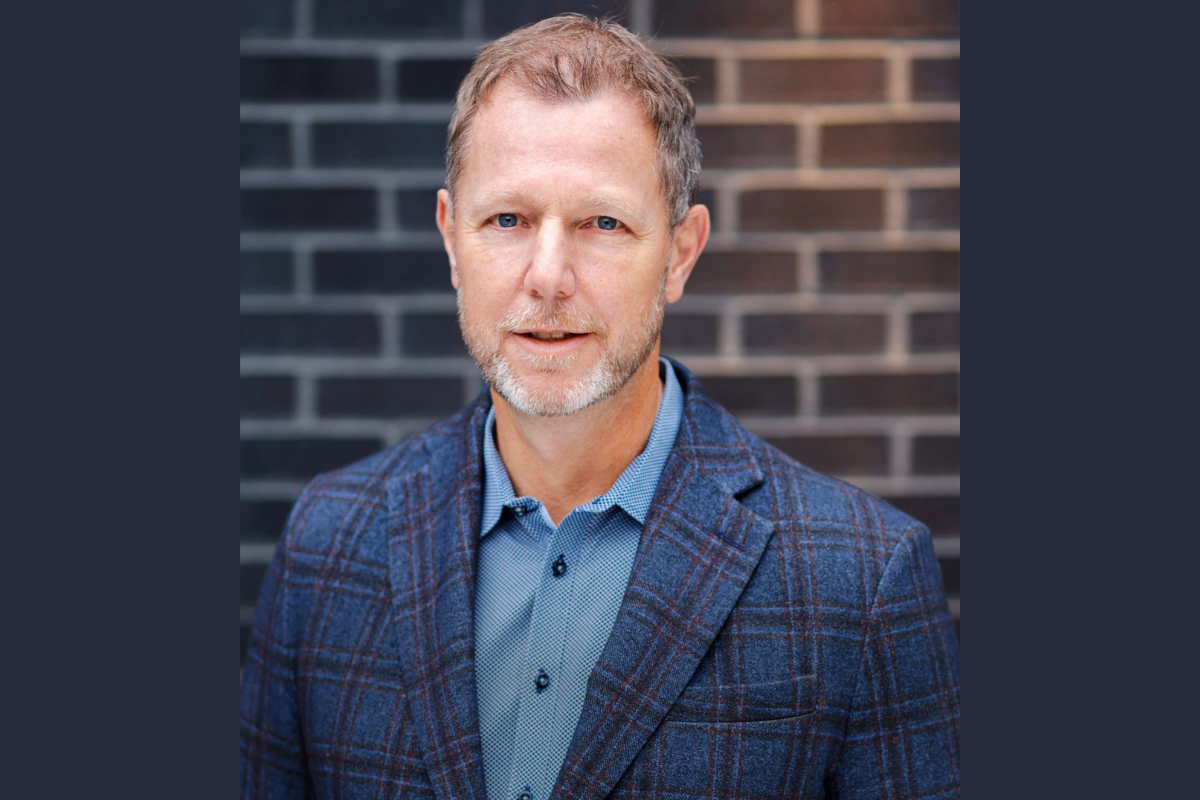

Care and trust are valuable currencies in the insurance industry, a fact Westland Insurance Vice Chair Jason Wubs understands to the hilt.

“I love the people side of our business,” he tells The CEO Magazine. “When I see people we’ve empowered and those who are energized by working for us, who are buying into what we’re trying to do, that’s the fuel that inspires me to do what I do.”

What Wubs – and by extension, Westland Insurance – does is maintain a network of Canada’s best independent insurance brokers. Buoyed by a formidable collective expertise, this network provides Westland’s clients with the best possible insurance solutions.

Being a family owned company means it is never far from its community roots, something Wubs works hard to maintain. In fact, by attracting and partnering with such a strong lineup of brokers, Westland has become something of a community in its own right.

“My father, who started this business in 1980, used to say that if you have an engaged workforce, if you have people that enjoy coming to work, you’re always going to be further ahead of the competition,” Wubs says. “That has stuck with me.”

We don’t necessarily have to be the largest, but we want to be the favorite.

Growing the business

By the time Wubs took up the title of CEO in 2009, he was already well-versed in the ways of Westland. “It was a smaller business then, but it was always growing,” he says. “We were always buying and acquiring brokerages. When I became CEO, we embarked upon a tremendous growth journey, which continues today.”

The direction for that journey comes from Wubs’ drive and passion for the business. “I’m incredibly competitive,” he says. “Right now we’re probably number four in Canada in terms of volume for brokerages, but in five years’ time we want to be in the top two. We don’t necessarily have to be the largest, but we want to be the favorite.”

To achieve this goal, Westland is in the midst of a seismic transformation. “We’ve gone from legacy, in-house systems to best-in-class technology,” he says. “We’ve done better with employee engagement, communication, training and education and collaboration.”

The pinnacle of this metamorphosis is Regenesis, Westland’s broker management operations portal. “It’s a foundation,” he says. “From there, we’re able to continue to evolve, not just from an efficiency standpoint, but to be able to interact with clients in whatever way they choose.”

Critical communication

An open line of communication with clients is critical to the pursuit of success in the insurance industry.

“We maintain a culture of collaboration and approachability for clients and partners both,” Wubs says. “We have a significant claims infrastructure, so we’re able to touch and influence the client experience to a higher degree than many of the country’s brokers, and we’ve done that through the investments we’ve made over the years, particularly in terms of talent.”

When Westland brings on new staff or partners, it’s done through a different lens, Wubs says.

“It’s perhaps a little cliche, but we have the courage to hire people and attract talent that sees the world in a unique way,” he says. “They have the tools to help Westland reach the next level.”

Whether that’s through traditional relationships with insurance companies such as Wawanesa or Intact Canada, or with bespoke partnerships with reinsurers such as Munich Re, Westland has the flexibility to work with the best in the business.

We want to represent an opportunity, whether it’s to our current clients, employees and partners or potential ones.

“That flexibility has come from building so many strong partnerships over the years, and it gives us the ability to create products and services that allow our clients to build out new verticals,” he says. “The more we acquire, the more we can influence and create growth opportunities for our organization.”

And that’s both external and internal. Westland’s new CEO, Jamie Lyons, took over the role from Wubs in January 2023 after a time as President and COO.

“We brought Jamie on seven years ago, and I always describe him as the smartest guy in the room,” Wubs says. “He also has tremendous humility and strong collaborative instincts, so it’s great we were able to give him that opportunity and have the company filtered through a new lens.”

The story of Westland, from its modest beginnings under his father’s stewardship to today, is a tale of amplifying possibilities, according to Wubs. “We want to represent an opportunity, whether it’s to our current clients, employees and partners or potential ones,” he says. “An opportunity to evolve, grow and advance in ways that are mutually beneficial.”