Deep within the Western Australian Wheatbelt, two hours east of Perth, the country town of Cunderdin embraces its heritage as a pioneering pastoral township. Although modern trappings have reached Cunderdin, thanks to the town’s airport and close proximity to Perth, there still remains a heavy focus on community that dates back to its inception.

The community isn’t just bound by a common interest in Cunderdin’s agricultural successes. Sport still has the power to bring the townsfolk together, be it at the swimming pool, the multifaceted Sport & Recreation Centre or the town’s array of well-kept public parks and gardens.

Throughout its 115-year history, these communal areas have remained hallowed ground – a lightning rod for community events and gatherings so crucial to maintaining a sense of unity.

Even today, Cunderdin is the kind of town where everyone knows each other, where parents gather after school drop-off to socialise in parks, where grandparents play with the kids in the garden while dinner’s cooking.

It’s the kind of town people look for when they decide to escape the big-city rat-race. It’s also the kind of town in which Nigel Satterley AM, Founder and CEO of Australia’s biggest private residential land developer, finds his inspiration. “We create communities, real communities, where people want to live,” he says.

“Communities where you know your neighbour, where the mums go to the parks. It’s called the old country town.” And Nigel should know: he was born and raised in Cunderdin. “When I was growing up, we knew everyone, the mums made lasting friends from the kindergartens and the primary schools, and everything was based around community and sport,” he shares. “They are the pillars of a town like this.”

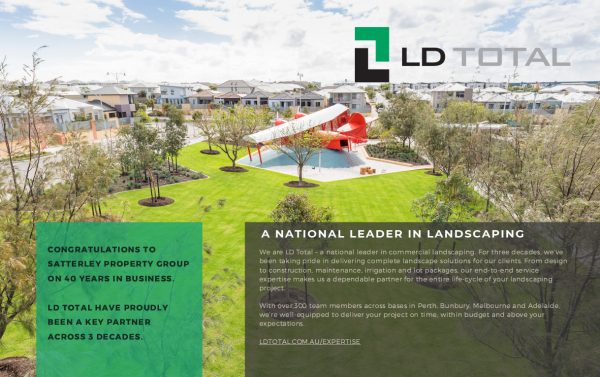

Indeed, these are the pillars of the kinds of communities Satterley Property Group strives to create. Since 1980, it has established 170 such communities across Australia, all driven by Nigel’s experience and vision. More than 250,000 Australians live on a Satterley lot. “I believe that with community creation or development and landscape parks, we do the best in Australia,” he says.

“And, at Satterley, we strive to build the most desirable residential communities in the country based on three things: environmental sustainability, top-shelf design principles and unique, in-house community development.”

The group has 100-plus industry awards to its name, named best-in-class for livability, innovation and quality. Hallmarks of a Satterley neighbourhood include sporting fields, access to jobs and transport, and beautifully landscaped parks.

Then there’s the in-house community development team, which works to create community events and activities to bring neighbours together. Much of this development is informed by the Cunderdin of Nigel’s youth, a place he’s still able to describe vividly.

I could visit one of my sites blindfolded and know if things aren’t operating to program.

“As the blocks got smaller, the parks became the family rooms for the parents after school drop-off. Some took coffee or a flask and the little kids all had a game,” he smiles.

“Then in the evening, the streets lit up as parents enjoyed a glass of wine while the kids mucked around before dinner, all that type of thing.” Even at its inception a little more than four decades ago, this vision was at the heart of Satterley Property Group’s work. Nigel had left Cunderdin for Perth to kick off his career.

“As a young man, I was the distributor for Levi’s Jeans in WA at a time when jeans were taking off,” he recalls. “I fell into it, I was lucky to get the WA franchise. But soon we were selling truckloads of jeans and I was thinking of opening up two stores in the city just specialising in jeans.”

Nigel’s deals and sizeable deposits attracted the attention of Town & Country Building Society Founder Sir James McCusker. “One day he asked me: ‘Why are you dealing in all this stuff? You’re mad. You should go into property.’ I kept thinking about what he’d said so, after about a year or so, I sold the jeans franchise and started my first property business, Statesman Homes.”

The jump from fashion wholesaler to property developer wasn’t as precipitous as it might have seemed. Nigel had already been buying and selling blocks of land for some time with his Levi’s commissions, and he also had the good fortune to get started in the midst of a significant property downturn in Perth.

“I understood the buying and selling of blocks well, and we were lucky because we had good energy. Also, the biggest builder listed went broke in 1974, so that gave us a good opening,” he reveals. The bust meant much of the competition was in a state of sluggishness that gave the agile young company an edge.

“A couple of the other building companies had been making lots of money, but they’d become a bit bloated and slow, so gradually Statesman became the number one building group.”

Being number one meant building up to 650 homes a year in WA – a preview of Nigel’s eventual vision for the state’s communities.

However, the success was short-lived; in 1979, Nigel decided Statesman had reached its potential and that it was time to sell. “Just by luck, a few months later, I was asked if I was interested in selling the company,” he says.

Footy fever

Just as Nigel’s country upbringing has contributed to Satterley’s culture, so too has his love of sport, particularly Aussie Rules. One of the founding fathers of the West Coast Eagles, Nigel says running a club is much like running a business. “Football is a great passion of mine. West Coast is the biggest sporting club in Australia, has the biggest membership, has the most money in the bank and has a very, very good board. The CEO is very good, the Chair’s very good and the gentleman who runs what we call ‘football operations’ is very good,” he explains. “If you haven’t got a good Board with good governance and a good CEO – who runs the contracts, the coaches and the players – you haven’t got a good club.” So good is West Coast’s management, Nigel says, that the club was able to grow its membership during the pandemic. “We became number one in Australia during COVID-19. The club is going to lose about A$1 million in cash while other clubs will lose between A$5 million and A$6 million. We’ve done well.” But even the best aren’t impervious to mistakes; Nigel cites the hiring of the late Ken Judge as West Coast coach in 2000 as an example of a “wrong fit”. “I was part of hiring Ken to coach. After six months, we knew we’d made the wrong decision for us and for Ken, bless his soul. So we paid him out. If you make mistakes, you’ve got to sort them out quickly,” he reveals.

“I picked the person I felt the most comfortable with, we agreed on the price and terms, and that was it.” But Nigel’s time in the property world wasn’t over yet. Land development had proved to be more appealing than building – not to mention far more lucrative.

It also gave him an outlet to re-create the kind of community he’d left behind in Cunderdin in a way home building never could. In 1980, he established Satterley Property Group with a firm focus on land development that still persists today.

“The landscaping and the community creation and development – they’re the things that set us apart,” he says. “We can move quickly on good acquisitions so the banks really support us.” Given Nigel’s experience as a major home builder, banks and finance houses began lining up to ask Satterley Property Group to help complete townhouse developments and duplexes.

“People had gone broke so they asked us to finish the job,” he explains. “We started off doing that as a kind of real estate doctor for the bankers, working with them on a lot of the mortgagee and possession situations. We’d fix these places and get the bankers’ money back.” This also gave Satterley a crash course in the dos and don’ts of the industry.

“As we were fixing, we’d look at why the original developers went broke,” Nigel tells. “The most common reasons were that they were too greedy, they didn’t meet the market or they paid far too much and thought inflation would settle it.”

The unconventional kickstart gave “Dr Satterley” the experience to spread his wings. “In the same year or so, we started doing the 65-square-metre, two-bedroom apartments in the close inner areas like Victoria Park, South Perth, Mount Lawley and Como,” Nigel says.

“We’d do walk-ups, two-storey apartments, in blocks of 12 up to 36.” The move away from building became total as Satterley established itself primarily as a developer. “We don’t compete with the home builders,” Nigel says.

“We supply the land for the builders because they’re our significant channel, and when they deal with us, they feel confident we’re not trying to pinch their new home customers or interfere with the process. So we have no conflicts of interest with the home-building industry.”

Such conflicts of interest can and do come up; however, Nigel believes a clear delineation between the two makes it easier for customers to make choices. “Some of the bigger builders do land development and that conflict of interest can be a problem for some people,” he says.

“They’ll go for us before they go for a builder-controlled estate.” Encouraged by the success of this early bank partnership, in 1982, Satterley Property Group teamed with Nigel’s old benefactor Town & Country for a project that set them on an exciting new course.

“That was our first land development site at Leeming,” he remembers. “Then after about two or three years, the land took over so we really moved away from the affordable apartments, which was sad. The land became very consuming of our time.”

If you’re in the wrong business, it usually comes out in the first 90 days.

That might have had something to do with Satterley’s home state of WA – it has an abundance of land and Nigel believes 90% of families prefer a house and land to the small blocks, duplexes and high-rises more common on the east coast.

“Each state’s a bit different. If you look at low-rise multi-residential townhouses right through to high-rise, 30% of Australians choose to live in that type of lifestyle – just not necessarily in Perth,” he suggests.

The biggest point of difference out west, he says, is size. Although the state is huge, the capital is not. “In greater Perth, there’s a population of around two million. It’s like a big country town – you know everyone,” he says.

“Melbourne’s a big place, but it’s very much who you know and what you know. Relationships are big in Melbourne.” Nigel’s relationships in Melbourne – as well as his lifelong love of sport – helped Satterley expand beyond WA’s borders and across Australia. “Melbourne is the biggest and most important greenfield market in Australia,” he insists.

“We were lucky because through AFL, we know all the main leaders and businesspeople in Melbourne, and that city has been very important to us. Really, I think in the past five years, it’s been our biggest business, and we’ll continue to expand our operations in Victoria.” Today, the group has a presence in Victoria and Queensland in addition to its WA activities.

“We’ll buy more things in Melbourne, we’re quite active in property acquisitions in south-east Queensland and in Perth, we’re just buying very selectively,” Nigel hints. The most recent of these buys was a A$50 million Perth purchase in 2019. Another was bought from the Catholic Church for A$15 million that same year – the fruit of one of Satterley’s longest and most beneficial partnerships.

“We’ve been partnered with the Western Australian Government and its development agencies since 1995. We’ve been partnered with the Catholic Church since 1991, and we’ve got a partnership with the Anglican Church. And then we have investors, both institutional and substantial families, who partner with us in the developments we do.”

Nigel’s steadfast commitment to sport, community, land development and urban renewal is a powerful force:

It has put people in their dream homes, kept the Australian community alive and earned West Coast four premierships. This was recognised in 2006 when Nigel received membership of the Order of Australia – one of many honours he’s received over the years. “The Order of Australia was a great honour and, as you know, not easy to get,” he says. “But when you’re humble, they’re all great to receive.”

The theological partnerships have been particularly beneficial, Nigel says. “In the first part of our venture with the Catholic Church, the Monsignor, who looked after the money, would sit in with two very experienced property people representing him on the board. We had two from our side, so they ran like serious businesses with good governance.”

The situation is similar with the Anglican Church; the Archbishop receives an annual briefing and inspects the assets. “They need those dividends to drive all their different agencies, helping those in need, including the homeless, the disabled, the aged and so on,” he clarifies.

Nigel believes the ongoing success of these trusted, long-term partnerships is the result of Satterley’s reputation in the industry and its low-debt property development model.

“When you’re transparent, when you do what you say you’re going to do and when your governance is strong, you’ll have people who are keen to reinvest with you,” he says. “We deal with good people – very good people – and people like doing things with other good people. We are seen now by the core family offices and wealthy families as a more sophisticated product provider.”

That public image makes Satterley the first choice of many looking to invest. “Lots will have a business, they own a commercial property, they’re in the equity market and they put some of their capital into the residential market. People spread their investments across four or five things.”

Such is the standing of Satterley with the banks, the Group is often called upon to revisit its “real estate doctor” role in a modern setting. “The banks are quite sophisticated, so they’ll come to us and say, ‘Here are good people, they need a capital injection and they might need some good opportunity management’, and we do that,” Nigel says.

“In other words, if they’re good people, they might have to sell down to us. We go in, put the capital and our brand into the project, and we can turn an asset around. In most cases, we save the borrower’s bacon.” In other cases, the banks recommend buyers for the company’s excess deals.

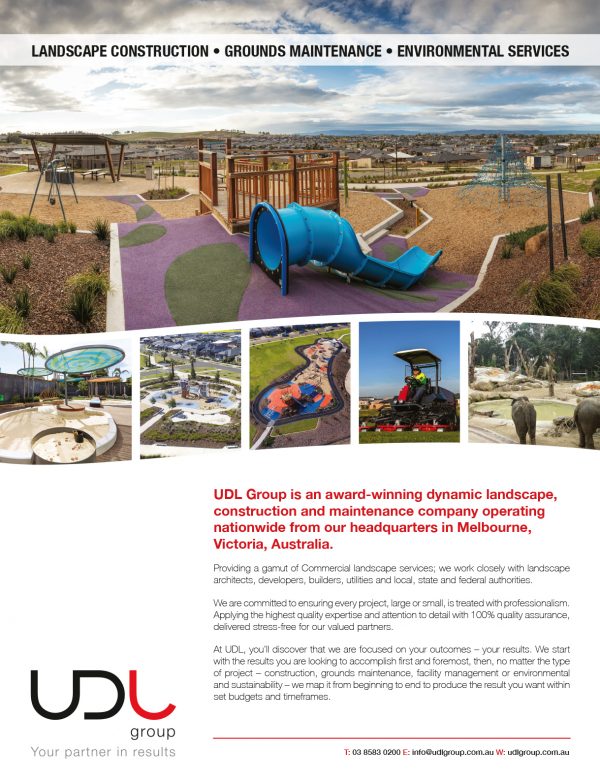

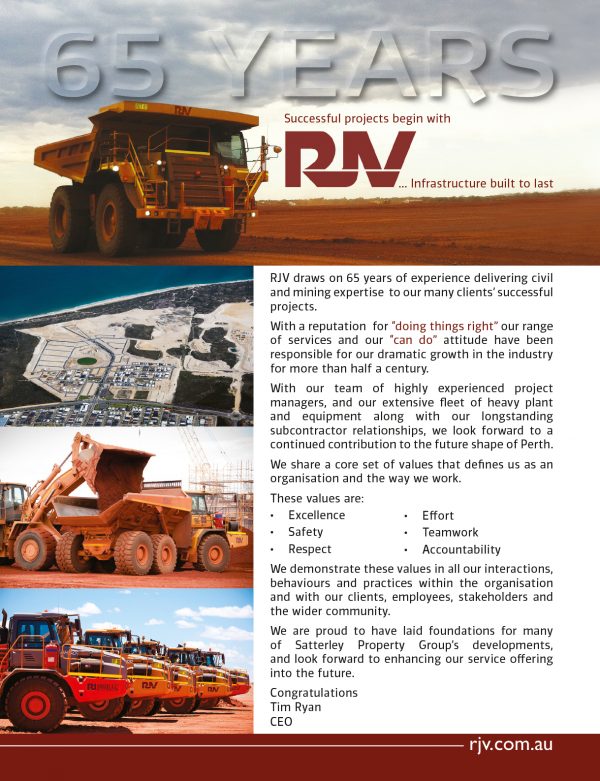

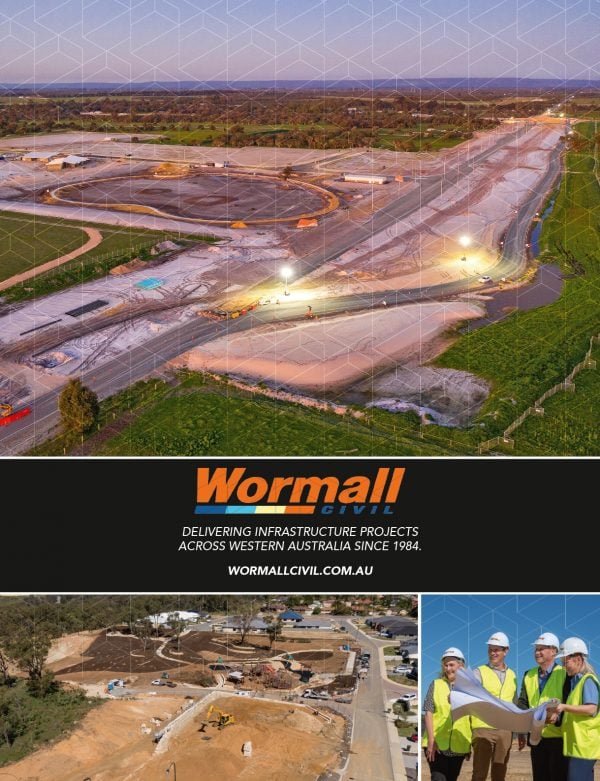

“People come to us because we can move quickly.” Also key to the company’s success is its relationships with civil contractors, landscapers and other service providers. “We use a selective tendering process and have been working with some of our contractors since our first years in business,” Nigel says.

Satterley’s renown in the industry is due in large part to Nigel’s own leadership philosophy, which seems increasingly unconventional in today’s era of delegation. “I lead by example. I tell the truth, and I don’t ask my staff to do anything I wouldn’t do myself,” he says, adding that he’s often been seen onsite on a weekend picking up rubbish.

“I’m likely the only property CEO in Australia who goes to their sites. I go on Saturdays when the customers are there so I know what’s going on. It’s the shop floor, so people can talk to me about their issues and what’s concerning them.”

Much like his vision for community building, Nigel’s personable style is informed by his country town childhood. “I came from a middle-class country family. My parents were terrific and really instilled in me the value of hard work,” he shares.

“You get a lot of people who don’t want to roll their sleeves up and work hard. They’re the people you have to put in the departure lounge.” As such, hard work and integrity have become the culture upon which the Satterley Property Group is built.

“Culture is very important,” Nigel asserts. “The property industry in Perth over the past five years has been pretty tough, so a culture that attracts people with integrity is good. For hard workers, it’s well paid and a very good industry to be in. On the other hand, if you’re in the wrong business, it usually comes out in the first 90 days.”

The global COVID-19 pandemic proved to be a test like no other – even the sterling Satterley team found themselves at the mercy of chaos. “It was like a roller-coaster,” Nigel admits.

“Very scary in March, April and May of 2020. March was the lowest sales month, then April, in Satterley’s history. In May, we had the best sales month for the financial year and in June, with the government stimulus boosts, we had the best national sales month in five years. It’s hard to believe. We are very grateful to the WA Government and the Federal Government for implementing these measures.”

The resilience of the Group’s partnerships was also put to the test. “When you’re in a pandemic or a world event, the first thing most people want to know is, ‘How safe is my equity?’ Their equity, with us, was very safe. We had very good communication and the banks were terrific,” he beams.

Ultimately, Satterley Property Group has emerged from the COVID-19 crisis in top form. “If the optimum of operating is 10, we’ll probably see FY21 at about an eight.” After 40 years, most of the kinks in the Satterley operation have been ironed out.

“There’s more competition now, so the risks have gone up a bit and the margin’s been compressed. It means you’ve got to have accuracy in all your numbers,” Nigel says.

“The banks have very sophisticated risk departments, technical people who look at all the operating cost lines. There’s a lot more around governance of your applications and earning trust with the bankers, which of course remains very important. Having trusted relationships with the banks is vital to a property company and we have excellent, longstanding relationships with all of the major banks.”

The Financial Services Royal Commission further rocked the industry when it began in 2017. “That was like a sledgehammer blow for our industry,” Nigel confesses.

“It had a big effect because it caused the banks to change the lending criteria for mums and dads, so that slowed sales in an already softening market. Thankfully, things have already improved; Australian banks are very, very good at lending to mums and dads.”

According to Nigel, the property development industry as a whole has become much more professional since he started his journey. “I think landscaping of parks has improved immeasurably,” he says.

“Now they’re what we call ‘destination parks’. We’ve got one where there’s a Catalina seaplane converted into a playground and slides – kids love it.” Destination playgrounds are starting to appear in Victoria and Queensland as communities continue to grow.”

I’m very hands-on … That’s the secret weapon.

Also growing is the community’s understanding of Aboriginal culture. DevelopmentWA and Satterley Property Group have formed an Aboriginal Engagement Plan for the Group’s Allara Estate in Eglinton. The plan seeks to educate the local community about Aboriginal and Torres Strait Islander cultures.

In Allara’s case, that education comes in the form of Moorditj Maara, an installation by Noongar artist Justin Martin. The initiative is designed as a conversation starter around the meaning of the area and the tribes who traditionally inhabited the land. One thing that hasn’t grown during Satterley’s four-decade lifespan, however, is the size of the lots.

“When I started, they were 700 square metres. Most probably the average size today is about 375 square metres,” Nigel says. The shrinkage means Satterley has to work harder to offer residents more housing choice for the land they have.

“In the future, we’re looking at a big focus on Melbourne and Queensland. We partner on affordable townhouses in Melbourne with the builders, so we’ll do more built form so there’s more housing choice. I think we’ll sell less of the special sites like shopping centres; we’ll develop them, but we’ll keep them.”

What won’t change is Satterley’s commitment to creating communities and providing amenity for the community. For Nigel, there’s too much value in the community to see them vanish along with the size of lots.

“Especially for the older residents, the grandparents, the size of the lot doesn’t matter as much,” he says, once again invoking the vision that drives him.

“The last thing they want is to go to a senior living complex. Why would they do that when they can live on a flat, 300-square-metre site with a lovely kitchen, a big, open living area, three good-sized bedrooms, some of them with bathrooms each, or two or three bathrooms? They just want to be close to where their kids and their grandchildren are living.”

It’s just another facet of the ideal community Nigel has spent his professional life creating. When he speaks of it, he reaches through a window to the past and channels the idyllic scene that awaits.

“A lot of couples both work these days, so it’s the grandparents taking the kids to school, running them around after school for sport, helping with the homework and in some cases, cooking dinner because mum and dad are working,” he states.

“We see so many grandparents sell up, cash out, get some cash back and buy a smaller home out near where their family lives.” Success, Nigel claims, can be measured by how far people are prepared to buy into the communities he creates.

“Hopefully, they double the house and land they purchased. If they buy the right product, the right house, it can double in a decade or so, that gives people a good superannuation and helps them with their families.” For all his achievements and sculpture, not just of land but also society, Nigel keeps his home life grounded.

“I’m pretty simple,” he shrugs. “I swim two kilometres every morning and I walk – I’d like to walk more – and on Sunday I do my reading. My wife and I also give around 5% of our pre-tax profit back to the community across a number of causes, particularly cancer-related causes. We do things where we can see we make a difference.”

True to his nature, he’s also an unflinching practitioner of neighbourly familiarity, despite modern attitudes. “We’re security conscious, so when we go away on holiday, we have someone live in the house, but I also make a point of telling the neighbours, ‘We’re going, but we’ll have someone in the house; here’s their phone number. Can we have yours?’ And they say, ‘Gee, that’s great that you’ve told us.’ And then when they go away, they tell us so we can keep an eye out for them. It’s a lost art,” Nigel reveals.

But Nigel is never too far from his passion; site visits take up many of his Saturdays. “I have a rule to visit most sites 20 times a year,” he says. “I could visit one of my sites blindfolded and know if things aren’t operating to program, if there are weeds growing somewhere. I find out a lot.

Harry Triguboff, who’s a genius, tells me he visits all his apartment sites once a week. He knows that going to make sure things are operating correctly is important.” In effect, Nigel’s affability and hands-on approach to property development is the secret weapon in his 40 years of success.

“I’m very hands-on and I know what’s happening, not just in the Group, but also at the shopfront. That’s the secret weapon,” he tells.

The constant visits to the mini-Cunderdins he’s created across Australia also afford Nigel the opportunity to see his vision of a thriving, friendly, unified Australian community come to life – and Saturday is prime time to see it in action.

“When dad’s cutting the lawn on a Saturday and he knows his neighbours, the kids all play together, the wives get on and everybody’s living in a caring community, that’s what’s most important to me.”

Proudly supported by: