Most people in business are great at what they do, but when you talk to them about financial figures, they run for the hills. There are 10 basic numbers and ratios every business owner just needs to know – and, luckily, they are easy and quick. Don’t worry, I’m not trying to make you an accountant, but I am trying to give you a basic understanding of the financial drivers of your business.

First, a caveat – never look at financial numbers in isolation. They should either be compared to the industry benchmarks and/or analysed over time as a trend.

Profitability numbers

These are numbers, ratios and margins that tell us whether your company is making an adequate return. Adequate return is subjective – what is adequate to one person, one investor, one owner, one banker or one industry?

Companies with a product or service that is easy to replicate or commoditise usually have low margins. Companies that have a competitive advantage or a barrier to entry usually have high margins. New products usually have a high margin to begin with and, as competition increases, the margin reduces.

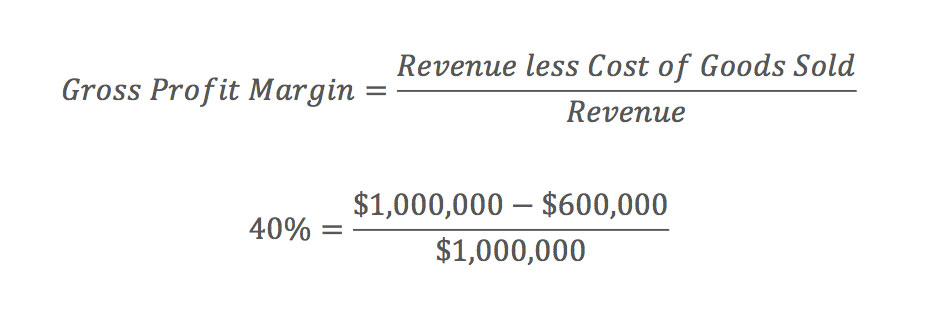

Gross profit margin

This ratio tells us how much revenue is left over after paying for the product that generated the revenue.

In the example above, 40% of the revenue is left over after paying for the product.

This number is important (and arguably the most important) because it will quickly tell us if there is sufficient revenue to cover the selling and administrative costs or overheads.

Increasing sales or revenues alone without understanding and managing the costs will create cashflow problems and make you unprofitable. Just looking at the gross profit margin will quickly tell you if you are in a good position.

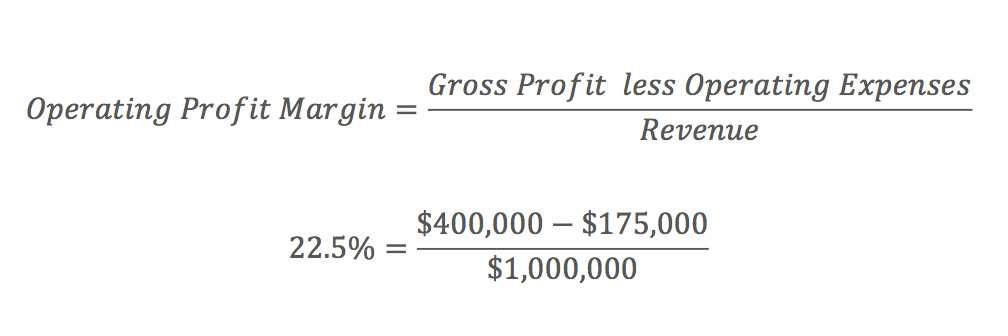

Operating profit margin

Operating profit margin tells us how much profit the business is generating after taking into account both the cost of goods sold and the operational and administrative expenses.

For sole trader businesses, I suggest excluding owners’ drawings, wages and expenses. For example, if you run a cafe, excluding the owner-related expenses will give you a better picture, as if the cafe is generating enough revenue to cover its running or operating costs. If the owner pays themselves too much and includes their costs in the operating costs, the picture the operating profit margin paints will distort the reality.

Operating profit margin is often confused with the ratio below – net profit margin.

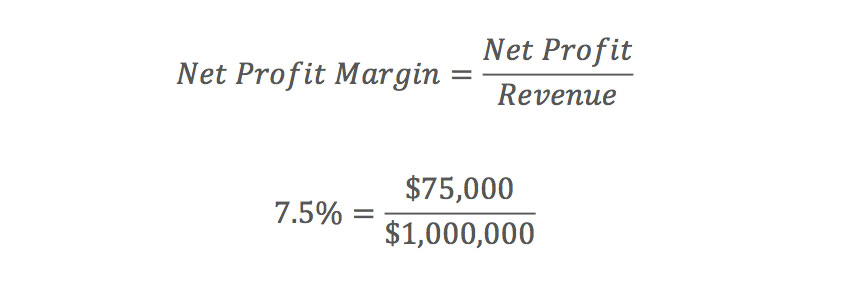

Net profit margin

The net profit margin shows the profitability of the business after accounting for all relevant costs. It also shows the return to the shareholder or owner.

This ratio should be analysed over time and you are looking for a consistent and strong ratio. Deterioration over time may indicate a period of abnormal costs or conditions. It may also show cost blowouts.

The ratio should be compared to the industry and/or the shareholder or owner’s expectation of adequate return. A low margin compared to the industry indicates a margin squeeze and that productivity improvements or initiatives are needed. A shareholder or business owner should expect a return representative of the risk of the investment.

Activity ratios: Activity ratios tell the business how efficiently they are using their short-term assets, especially cash, and show operational performance.

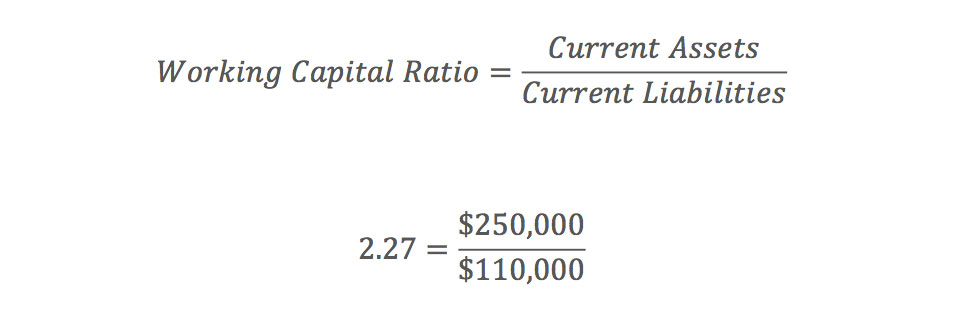

Working capital (current ratio)

The working capital ratio can give an indication of the ability of your business to pay its bills.

A stronger ratio indicates a better ability to meet ongoing and unexpected bills, therefore, taking the pressure off your cashflow. Being in a ‘liquid’ position can also have advantages such as being able to negotiate cash discounts with your suppliers.

A weaker ratio may indicate that your business is having greater difficulties meeting its short-term commitments and that additional working capital support is required. Having to pay bills before payments are received may be the issue, in which case, an overdraft could assist. Alternatively, building up a reserve of cash investments may create a sound working capital buffer.

Net working capital can also estimate the ability of a company to grow quickly. If it has substantial cash reserves, it may have enough cash to rapidly scale up the business. Conversely, a tight working capital situation makes it unlikely that a business has the financial means to speed up its rate of growth. A working capital ratio greater than two is usually considered desirable; however, it is a matter of balance.

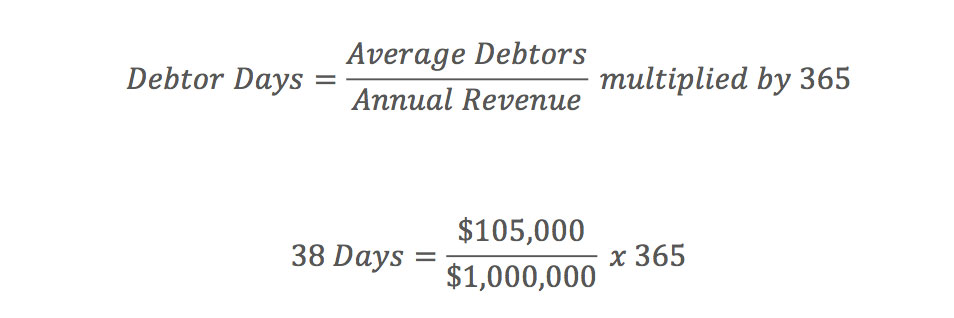

Debtor days

Debtor days shows the average length of time it takes from when you make the sale to when you receive payment. This measures how quickly and efficiently a business collects its outstanding bills.

A larger number of debtor days means that a business must invest more cash in its unpaid accounts receivable asset, while a smaller number implies that there is a smaller investment in accounts receivable and more cash is, therefore, being made available for other uses.

Debtor days should be looked at over time to see if there is a trend. A long debtor days may indicate that customers are struggling to pay their accounts, or lax credit monitoring. Also, economic factors such as a recession may lengthen debtor days and may require a tightening of credit control processes.

Generally, lower debtor days numbers are better. However, a low debtor days compared to the industry benchmark may mean your credit terms are too stringent and that you are potentially missing out on sales opportunities.

It is also a useful exercise to list your debtors and then order them by how outstanding they are. This is known as an aged debtors report. This report divides the age of the accounts receivable into various buckets, which you can sometimes alter within the accounting software to match your billing terms. The most common time buckets are from 0–30 days old, 31–60 days old, 61–90 days old, and older than 90 days.

Any invoices falling into the time buckets representing periods greater than 120 days are cause for an increasing sense of alarm. This report prioritises the debtors that need following up, and accounting software systems will often also provide the contact name, email address and phone number.

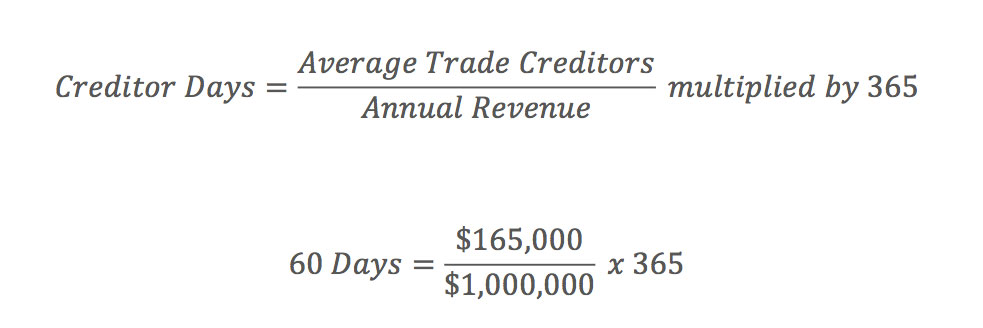

Creditor days

Creditor days indicate the average length of time it takes your business to pay its bills.

Again, this ratio needs to look at a trend and be compared to industry benchmarks. A declining ratio may indicate a worsening working capital position because of a decreasing stock turn or lengthening debtor days.

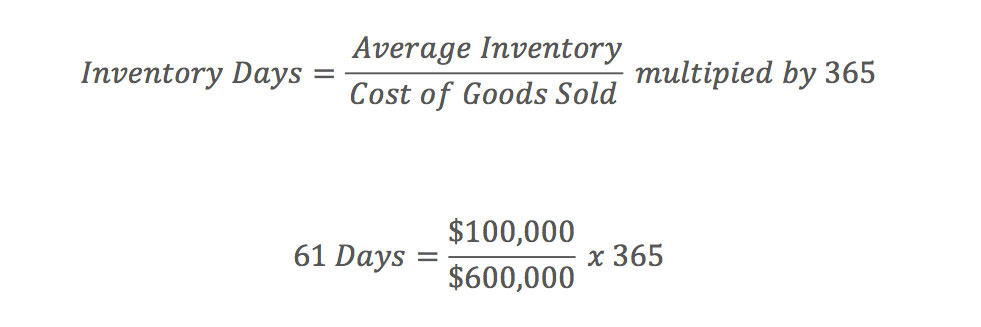

Inventory days or stock turn

The inventory days or stock turn shows how many days it takes for the inventory to be sold and replaced.

For service-based businesses, replace average inventory with average work in progress.

A low inventory days may indicate positive factors such as good stock demand and management. It also means fewer resources (usually cash) tied up in inventory. However, an inventory days that is too low may be a sign that the inventory levels are too low and unable to support an increase in demand.

A high inventory days may indicate that stock is naturally slow moving or there are problems such as obsolete stock or good presentation. This can also indicate potential stock valuation issues.

A caveat – inventory days is very industry specific. An industry where the inventory is not perishable or goes out of date, it may be appropriate to have a higher inventory days. Likewise, where the goods are imported, and it takes time to replace inventory, it may be appropriate to hold more inventory, such as cars.

Liquidity ratios: Liquidity ratios measure the business’s ability to meet its short-term liabilities. They are especially important to banks and creditors when applying for loans or credit applications.

Current ratio

Current ratio is also known as working capital ratio and is discussed above. It indicates if the business can pay off its short-term liabilities in an emergency by liquidating its current assets.

A high current ratio indicates a good level of liquidity, but if the ratio is too high, it may indicate other problems. The inventory levels may be too high, valued incorrectly or include too much obsolete inventory. There also may be a high debtor balance due to poor credit control or payment terms that are too generous.

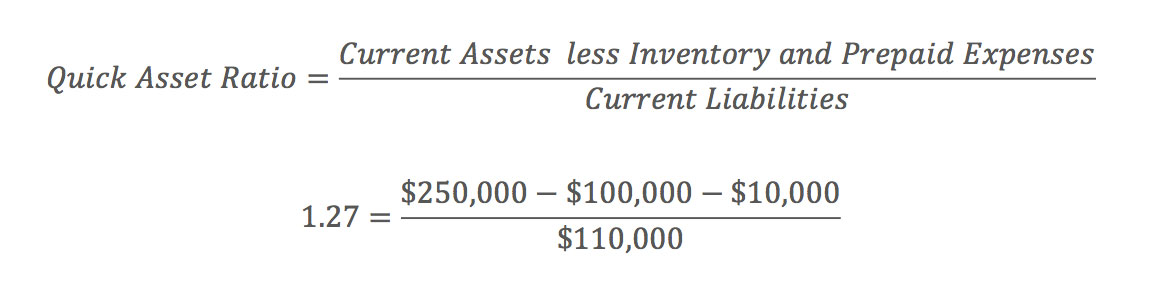

Quick asset ratio

The quick asset ratio gives a more conservative measure of liquidity than the current ratio. The quick asset ratio excludes inventory, as the value of the inventory that is realised in a fire sale situation would be a lot less than the book value. It should also exclude any prepaid expenses.

In the example above, the quick asset ratio greater than one indicates that current liabilities can be met from the current assets without having to liquidate inventory.

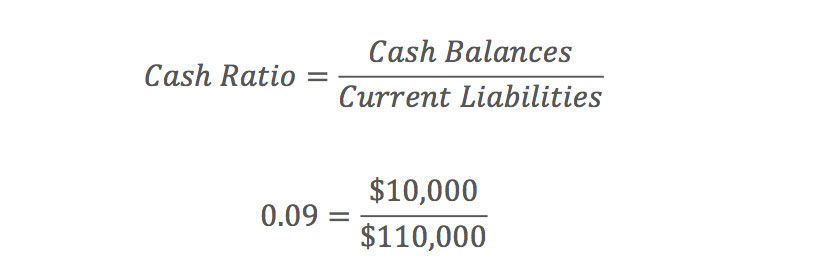

Cash ratio

The cash ratio is like the quick asset ratio but excludes any other non-cash current assets such as debtors. It is the most conservative liquidity ratio.

To make the most of the information these ratios provide, you must understand what the information is telling you and how to apply it in your business. Again, business owners can learn all about this easily and quickly. Most business advisory accountants could take you through your company and how your figures are affecting your financial performance, so you can see what you must do to run your business better.

Read next: How performance metrics can unlock better performance