Have you seen the movie Jerry Maguire? If so you must remember the iconic line where Cuba Gooding Jr’s character tells Tom Cruise’s character “Show me the money!”

Today we are going to ask the question, what comes first: high income or high property prices? Is there a chicken or an egg relationship between income distribution and property prices in Australia? In other words, do higher incomes in a local geographic location lead to higher local housing prices? Or do higher levels of local amenity, prestige and/or infrastructure attract people on higher levels of income to move to a particular area?

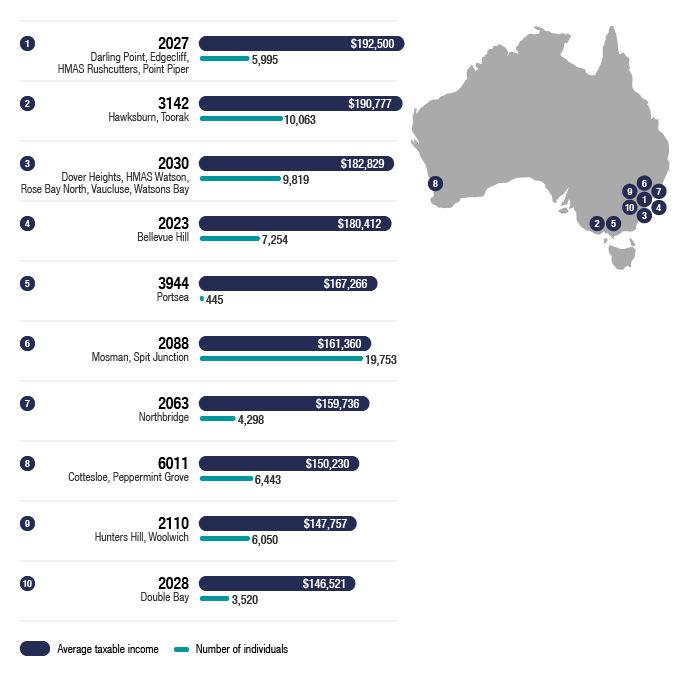

Clearly, there is an association between income distribution and median house prices with the highest-income earners tending to congregate in the most prestigious addresses.

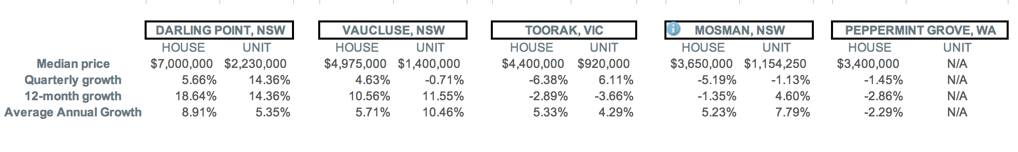

According to data supplied by CoreLogic below, there is no denying that the top income earners in the top 10 postcodes listed in the ATO 2015-16 data above also attract premium property prices.

If we assume that the long-run average for Australian property price growth is 8.1% p.a. (as reported by the Bank of International Settlements last year) then we can see that some of these suburbs have outperformed the average, while others have fallen short.

Additionally, we can see that houses in these prestigious suburbs have not always outperformed units in these suburbs. For example, Mosman and Vaucluse in NSW have seen unit prices outperform house prices. Affordability is a major factor, where more buyers are able to purchase units as opposed to houses in these ultra-expensive suburbs, thus pushing up demand.

So, at face value, there would appear to be no correlation between those postcodes with the highest incomes and their respective annual growth rates. What is evident though is that those areas with the highest median property prices seem to attract the highest-income earners.

3 reasons high income earners and high median property go hand in hand

-

Location, location, location

If we look at the location of all of the postcodes that make the top 10, we can see that most of them are located relatively close to the major CBD of their state. Most of them offer high-quality amenity and lifestyle features such as proximity to water, tree-lined streets, parks, high-quality schools and more.

-

Like attracts like

Another factor that may cause high-income earners to aggregate in these postcodes is the desire to be around people with similar interests and levels of affluence, and the prospect of opportunities to network with fellow successful and high-income earning people.

-

The prestige premium

As human beings we are often driven by the lure of prestige and the trappings that having the best car, clothes, handbags, jewellery or postcode may bring. We will often pay more for a brand that is perceived to be of either higher quality, expense or prestige.

For example, you may choose to drive the latest BMW, Mercedes or Rolls-Royce even though all cars can deliver you from A to B. Car enthusiasts may argue that you don’t get the same speed, luxury and comfort. But this is where the effect of human ambition and the desire to acquire the best in life may see these high-income earners pile into the ‘best’ or at least highest-priced postcodes.